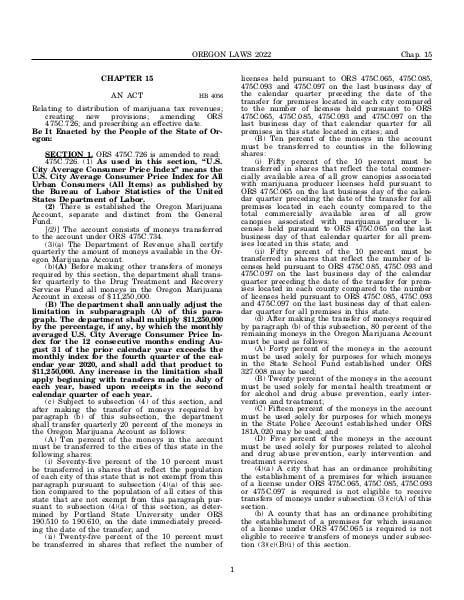

ORS 475C.726

Oregon Marijuana Account

Amended by HB 4056

Effective since June 3, 2022

Relating to distribution of marijuana tax revenues; creating new provisions; amending ORS 475C.726; and prescribing an effective date.

(1)

There is established the Oregon Marijuana Account, separate and distinct from the General Fund.(2)

The account consists of moneys transferred to the account under ORS 475C.734 (Suspense account).(3)

Intentionally left blank —Ed.(a)

The Department of Revenue shall certify quarterly the amount of moneys available in the Oregon Marijuana Account.(b)

Before making other transfers of moneys required by this section, the department shall transfer quarterly to the Drug Treatment and Recovery Services Fund all moneys in the Oregon Marijuana Account in excess of $11,250,000.(c)

Subject to subsection (4) of this section, and after making the transfer of moneys required by paragraph (b) of this subsection, the department shall transfer quarterly 20 percent of the moneys in the Oregon Marijuana Account as follows:(A)

Ten percent of the moneys in the account must be transferred to the cities of this state in the following shares:(i)

Seventy-five percent of the 10 percent must be transferred in shares that reflect the population of each city of this state that is not exempt from this paragraph pursuant to subsection (4)(a) of this section compared to the population of all cities of this state that are not exempt from this paragraph pursuant to subsection (4)(a) of this section, as determined by Portland State University under ORS 190.510 (Definitions for ORS 190.510 to 190.610) to 190.610 (State census program), on the date immediately preceding the date of the transfer; and(ii)

Twenty-five percent of the 10 percent must be transferred in shares that reflect the number of licenses held pursuant to ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) and 475C.097 (Retail license) on the last business day of the calendar quarter preceding the date of the transfer for premises located in each city compared to the number of licenses held pursuant to ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) and 475C.097 (Retail license) on the last business day of that calendar quarter for all premises in this state located in cities; and(B)

Ten percent of the moneys in the account must be transferred to counties in the following shares:(i)

Fifty percent of the 10 percent must be transferred in shares that reflect the total commercially available area of all grow canopies associated with marijuana producer licenses held pursuant to ORS 475C.065 (Production license) on the last business day of the calendar quarter preceding the date of the transfer for all premises located in each county compared to the total commercially available area of all grow canopies associated with marijuana producer licenses held pursuant to ORS 475C.065 (Production license) on the last business day of that calendar quarter for all premises located in this state; and(ii)

Fifty percent of the 10 percent must be transferred in shares that reflect the number of licenses held pursuant to ORS 475C.085 (Processor license), 475C.093 (Wholesale license) and 475C.097 (Retail license) on the last business day of the calendar quarter preceding the date of the transfer for premises located in each county compared to the number of licenses held pursuant to ORS 475C.085 (Processor license), 475C.093 (Wholesale license) and 475C.097 (Retail license) on the last business day of that calendar quarter for all premises in this state.(d)

After making the transfer of moneys required by paragraph (b) of this subsection, 80 percent of the remaining moneys in the Oregon Marijuana Account must be used as follows:(A)

Forty percent of the moneys in the account must be used solely for purposes for which moneys in the State School Fund established under ORS 327.008 (State School Fund) may be used;(B)

Twenty percent of the moneys in the account must be used solely for mental health treatment or for alcohol and drug abuse prevention, early intervention and treatment;(C)

Fifteen percent of the moneys in the account must be used solely for purposes for which moneys in the State Police Account established under ORS 181A.020 (State Police Account) may be used; and(D)

Five percent of the moneys in the account must be used solely for purposes related to alcohol and drug abuse prevention, early intervention and treatment services.(4)

Intentionally left blank —Ed.(a)

A city that has an ordinance prohibiting the establishment of a premises for which issuance of a license under ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) or 475C.097 (Retail license) is required is not eligible to receive transfers of moneys under subsection (3)(c)(A) of this section.(b)

A county that has an ordinance prohibiting the establishment of a premises for which issuance of a license under ORS 475C.065 (Production license) is required is not eligible to receive transfers of moneys under subsection (3)(c)(B)(i) of this section.(c)

A county that has an ordinance prohibiting the establishment of a premises for which issuance of a license under ORS 475C.085 (Processor license), 475C.093 (Wholesale license) or 475C.097 (Retail license) is required is not eligible to receive transfers of moneys under subsection (3)(c)(B)(ii) of this section.(d)

Intentionally left blank —Ed.(A)

Paragraphs (b) and (c) of this subsection do not apply to a county ordinance adopted on or after January 1, 2018, that prohibits the establishment of a premises for which a license under ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) or 475C.097 (Retail license) is required but allows in the unincorporated area of the county the continued operation of an existing premises for which a license under ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) or 475C.097 (Retail license) is required.(B)

A county that adopts an ordinance described in subparagraph (A) of this paragraph shall certify the adoption of the ordinance under subsection (6) of this section.(5)

Intentionally left blank —Ed.(a)

A city or county that is ineligible under subsection (4) of this section to receive a transfer of moneys from the Oregon Marijuana Account during a given quarter but has received a transfer of moneys for that quarter shall return the amount transferred to the Department of Revenue, with interest as described under paragraph (f) of this subsection. An ineligible city or county may voluntarily transfer the moneys to the Department of Revenue immediately upon receipt of the ineligible transfer.(b)

If the Director of the Oregon Department of Administrative Services determines that a city or county received a transfer of moneys under subsection (3)(c) of this section but was ineligible to receive that transfer under subsection (4) of this section, the director shall provide notice to the ineligible city or county and order the city or county to return the amount received to the Department of Revenue, with interest as described under paragraph (f) of this subsection. A city or county may appeal the order within 30 days of the date of the order under the procedures for a contested case under ORS chapter 183.(c)

As soon as the order under paragraph (b) of this subsection becomes final, the director shall notify the Department of Revenue and the ineligible city or county. Upon notification, the Department of Revenue immediately shall proceed to collect the amount stated in the notice.(d)

The Department of Revenue shall have the benefit of all laws of the state pertaining to the collection of income and excise taxes and may proceed to collect the amounts described in the notice under paragraph (c) of this subsection. An assessment of tax is not necessary and the collection described in this subsection is not precluded by any statute of limitations.(e)

If a city or county is subject to an order to return moneys from an ineligible transfer, the city or county shall be denied any further relief in connection with the ineligible transfer on or after the date that the order becomes final.(f)

Interest under this section shall accrue at the rate established in ORS 305.220 (Interest on deficiency, delinquency or refunds) beginning on the date the ineligible transfer was made.(g)

Both the moneys and the interest collected from or returned by an ineligible city or county shall be redistributed to the cities or counties that were eligible to receive a transfer under subsection (3)(c) of this section on the date the ineligible transfer was made.(6)

Intentionally left blank —Ed.(a)

Not later than July 1 of each year, each city and county in this state shall certify with the Oregon Department of Administrative Services whether the city or county has an ordinance prohibiting the establishment of a premises for which issuance of a license under ORS 475C.065 (Production license), 475C.085 (Processor license), 475C.093 (Wholesale license) or 475C.097 (Retail license) is required and whether the county has an ordinance described in subsection (4)(d) of this section. The certification shall be made concurrently with the certifications under ORS 221.770 (Revenue sharing to cities), in a form and manner prescribed by the Oregon Department of Administrative Services.(b)

If a city fails to comply with this subsection, the city is not eligible to receive transfers of moneys under subsection (3)(c)(A) of this section. If a county fails to comply with this subsection, the county is not eligible to receive transfers of moneys under subsection (3)(c)(B) of this section.(c)

A city or county that repeals an ordinance as provided in ORS 475C.457 (Repeal of city, county ordinance that prohibits certain establishments) shall file an updated certification with the Oregon Department of Administrative Services in a form and manner prescribed by the department, noting the effective date of the change. A city or county that repeals an ordinance as provided in ORS 475C.457 (Repeal of city, county ordinance that prohibits certain establishments) is eligible to receive quarterly transfers of moneys under this section for quarters where the repeal is effective for the entire quarter and the updated certification was filed at least 30 days before the date of transfer. [Formerly 475B.759]

Source:

Section 475C.726 — Oregon Marijuana Account, https://www.oregonlegislature.gov/bills_laws/ors/ors475C.html.