ORS 315.208

Dependent care facilities

Amended by HB 4005

Effective since March 9, 2022

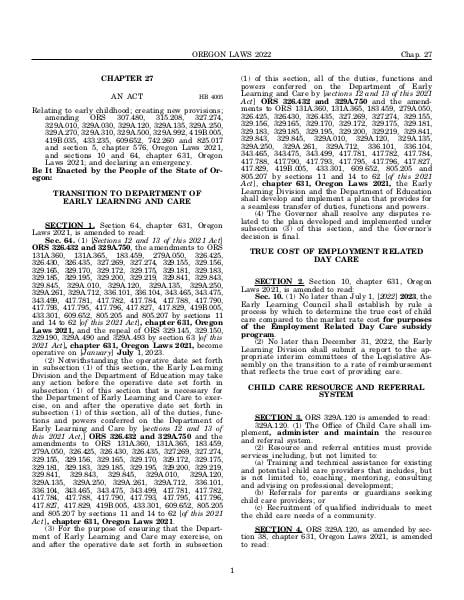

Relating to early childhood; creating new provisions; amending ORS 307.480, 315.208, 327.274, 329A.010, 329A.030, 329A.120, 329A.135, 329A.250, 329A.270, 329A.310, 329A.500, 329A.992, 419B.005, 419B.035, 433.235, 609.652, 742.260 and 825.017 and section 5, chapter 576, Oregon Laws 2021, and sections 10 and 64, chapter 631, Oregon Laws 2021; and declaring an emergency.

(1)

A credit against the taxes otherwise due under ORS chapter 316 (or, if the taxpayer is a corporation that is an employer, under ORS chapter 317 or 318) is allowed to an employer, based upon costs actually paid or incurred by the employer, to acquire, construct, reconstruct, renovate or otherwise improve real property so that the property may be used primarily as a dependent care facility.(2)

The credit allowed under this section shall be the least of:(a)

$2,500 multiplied by the number of full-time equivalent employees employed by the employer (on the property or within such proximity to the property that any dependents of the employees may be cared for in the facility) on any date within the two years immediately preceding the end of the first tax year for which credit is first claimed;(b)

Fifty percent of the cost of the acquisition, construction, reconstruction, renovation or other improvement; or(c)

$100,000.(3)

To qualify for the credit allowed under subsection (1) of this section:(a)

The amounts paid or incurred by the employer for the acquisition, construction, reconstruction, renovation or other improvement to real property may be paid or incurred either:(A)

To another to be used to acquire, construct, reconstruct, renovate or otherwise improve real property to the end that it may be used as a dependent care facility with which the employer contracts to make dependent care assistance payments which payments are wholly or partially entitled to exclusion from income of the employee for federal tax purposes under section 129 of the Internal Revenue Code; or(B)

To acquire, construct, reconstruct, renovate or otherwise improve real property to the end that it may be operated by the employer, or a combination of employers, to provide dependent care assistance to the employees of the employer under a program or programs under which the assistance is, under section 129 of the Internal Revenue Code, wholly or partially excluded from the income of the employee.(b)

The property must be in actual use as a dependent care facility on the last day of the tax year for which credit is claimed and dependent care services assisted by the employer must take place on the acquired, constructed, reconstructed, renovated or improved property and must be entitled to an exclusion (whole or partial) from the income of the employee for federal tax purposes under section 129 of the Internal Revenue Code on the last day of the tax year for which credit is claimed.(c)

The person or persons operating the dependent care facility on the property acquired, constructed, reconstructed, renovated or improved must hold a certification (temporary or not) issued under ORS 329A.030 (Central Background Registry) and 329A.250 (Definitions for ORS 329A.030 and 329A.250 to 329A.450) to 329A.450 (Assistance to staff of facility) by the Office of Child Care to operate the facility on the property on the last day of the tax year of any tax year in which credit under this section is claimed.(d)

The dependent care facility acquired, constructed, reconstructed, renovated or otherwise improved must be located in Oregon. No credit shall be allowed under this section if the dependent care facility is not acquired, constructed, reconstructed, renovated or improved to accommodate six or more children.(e)

The employer must meet any other requirements or furnish any information, including information furnished by the employees or person operating the dependent care facility, to the Department of Revenue that the department requires under its rules to carry out the purposes of this section.(f)

The dependent care facility, the costs of the acquisition, construction, reconstruction, renovation or improvement upon which the credit granted under this section is based, must be placed in operation before January 1, 2002.(4)

The total amount of the costs upon which the credit allowable under this section is based, and the total amount of the credit, shall be determined by the employer, subject to any rules adopted by the department, during the tax year in which the property acquired, constructed, reconstructed, renovated or otherwise improved is first placed in operation as a dependent care facility certified by the Office of Child Care under ORS 329A.030 (Central Background Registry) and 329A.250 (Definitions for ORS 329A.030 and 329A.250 to 329A.450) to 329A.450 (Assistance to staff of facility). One-tenth of the total credit is allowable in that tax year and one-tenth of the total credit is allowable in each succeeding tax year, not to exceed nine tax years, thereafter. No credit shall be allowed under this section for any tax year at the end of which the dependent care facility is not in actual operation under a current certification (temporary or not) issued by the Office of Child Care nor shall any credit be allowed for any tax year at the end of which the employer is not providing dependent care assistance entitled to exclusion (whole or partial) from employee income for federal tax purposes under section 129 of the Internal Revenue Code for dependent care on the property. Any tax credit allowable under this section in a tax year may be carried forward in the same manner and to the same tax years as if it were a tax credit described in ORS 315.204 (Dependent care assistance).(5)

Nothing in this section shall affect the computation of depreciation or basis of a dependent care facility. If a deduction is allowed for purposes of ORS chapter 316, 317 or 318 for the amounts paid or incurred upon which the credit under this section is based, the deduction shall be reduced by the dollar amount of the credit granted under this section.(6)

For purposes of the credit allowed under this section:(a)

The definitions and special rules contained in section 129(e) of the Internal Revenue Code shall apply to the extent applicable.(b)

“Employer” means a resident, part-year resident or full-year nonresident employer carrying on a business, trade, occupation or profession in this state.(7)

The department shall require that evidence that the person operating the dependent care facility on the date that the taxpayer’s tax year ends holds a current certification (temporary or otherwise) to operate the facility accompany the tax return on which any amount of tax credit granted under this section is claimed, or that such evidence be separately furnished. If the evidence is not so furnished, no credit shall be allowed for the tax year for which the evidence is not furnished. The Office of Child Care shall cooperate by making such evidence, in an appropriate form, available to the person operating the facility, if the person is currently certified (temporary or not) so that, if necessary, it may be made available to the taxpayer. [1993 c.730 §24 (enacted in lieu of 316.132, 317.114 and 318.160); 1997 c.325 §37; 1997 c.839 §66; 1999 c.743 §21; 2009 c.33 §18; 2013 c.624 §78; 2017 c.315 §20]

Source:

Section 315.208 — Dependent care facilities, https://www.oregonlegislature.gov/bills_laws/ors/ors315.html.