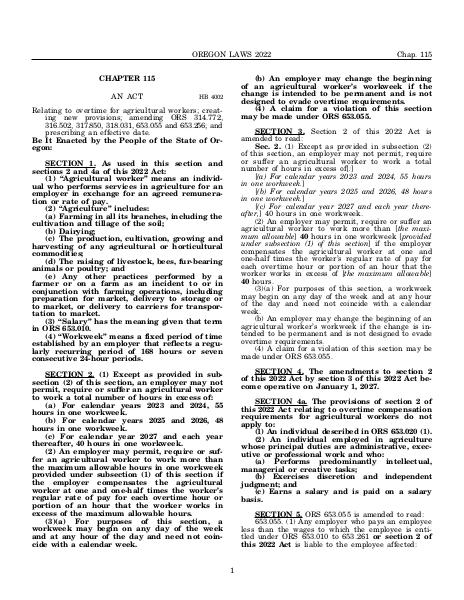

Liability of noncomplying employer

- contrary agreements no defense

- wage claims

- suits to enjoin future violations

- attorney fees

Source:

Section 653.055 — Liability of noncomplying employer; contrary agreements no defense; wage claims; suits to enjoin future violations; attorney fees, https://www.oregonlegislature.gov/bills_laws/ors/ors653.html.

Notes of Decisions

Under this section, where Labor Commissioner sued as assignee of affected employes, prevailing defendant-employer was not entitled to attorney fees. State ex rel Stevenson v. Youth Adventures, 42 Or App 263, 600 P2d 880 (1979), Sup Ct review denied

“Civil penalties provided in ORS 652.150” refers to method for calculating minimum wage or overtime violation penalty and does not result in penalty being merged with penalty for failure to pay wages at termination. Cornier v. Paul Tulacz, DVM PC, 176 Or App 245, 30 P3d 1210 (2001)

Where employer failed to pay overtime wages, subsequent termination of employment did not provide basis for additional claim based on nonpayment of same wages at termination. Mathis v. Housing Authority of Umatilla County, 242 F. Supp. 2d 777 (D. Or. 2002)

Reference to ORS 652.150 under subsection (1) of this section includes need to establish that employer’s failure to pay wages is willful in order to impose civil penalties. Migis v. Autozone, Inc., 282 Or App 774, 387 P3d 381 (2016)