ORS 657.462

Computation of benefit ratio

- grouping employers within cumulative taxable payroll percentage limits

- assignment of rates

Amended by HB 4035

Effective since June 6, 2024

Relating to unemployment insurance taxes; creating new provisions; amending ORS 652.409, 657.462 and 657.783; repealing ORS 657.439 and 657.463; and prescribing an effective date.

(1)

The Director of the Employment Department or the director’s authorized representative shall, for each calendar year, compute a benefit ratio for each employer who meets the requirements of this section. For an employer whose record has been chargeable with benefits throughout the 12 preceding calendar quarters ending on the computation date, the benefit ratio shall be a quotient obtained by dividing the total benefit charges to the employer’s record in the 12 calendar quarters by the total of the employer’s taxable payrolls for the same 12 calendar quarters. For an employer whose record has been chargeable with benefits for at least four or more consecutive calendar quarters but less than 12 consecutive calendar quarters and ending on the computation date, the benefit ratio shall be the quotient obtained by dividing the total benefits charged to the employer’s record for the consecutive calendar quarters by the total of the employer’s taxable payrolls for the same period. Benefit ratios shall be carried out to the sixth decimal place.(2)

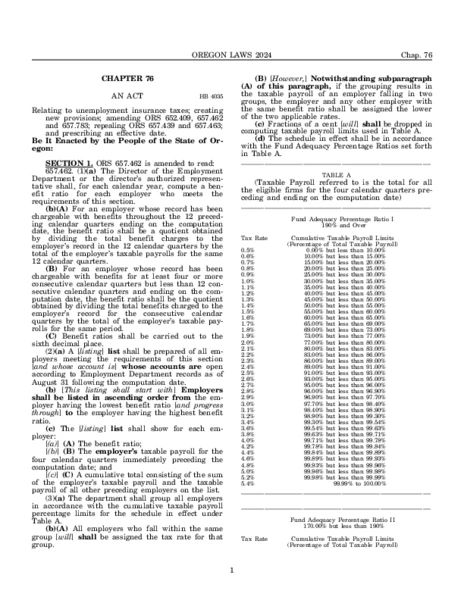

A listing shall be prepared of all employers meeting the requirements of this section and whose account is open according to Employment Department records as of August 31 following the computation date. This listing shall start with the employer having the lowest benefit ratio and progress through the employer having the highest benefit ratio. The listing shall show for each employer:(a)

The benefit ratio;(b)

The taxable payroll for the four calendar quarters immediately preceding the computation date; and(c)

A cumulative total consisting of the sum of the employer’s taxable payroll and the taxable payroll of all other preceding employers on the list.(3)

The department shall group all employers in accordance with the cumulative taxable payroll percentage limits for the schedule in effect under Table A. All employers who fall within the same group will be assigned the tax rate for that group. However, if the grouping results in the taxable payroll of an employer falling in two groups, the employer and any other employer with the same benefit ratio shall be assigned the lower of the two applicable rates. Fractions of a cent will be dropped in computing taxable payroll limits used in Table A. The schedule in effect shall be in accordance with the Fund Adequacy Percentage Ratios set forth in Table A.[1963 c.302 §2; 1967 c.434 §3; 1973 c.810 §2; 1975 c.354 §3; 1981 c.751 §4; 1983 c.818 §1; 1995 c.173 §1; 2001 c.885 §2; 2005 c.183 §8; 2021 c.638 §7]

Source:

Section 657.462 — Computation of benefit ratio; grouping employers within cumulative taxable payroll percentage limits; assignment of rates, https://www.oregonlegislature.gov/bills_laws/ors/ors657.html (accessed May 26, 2025).