ORS 750.055

Other provisions applicable to health care service contractors

- rules

Amended by SB 1529

Effective since March 17, 2022

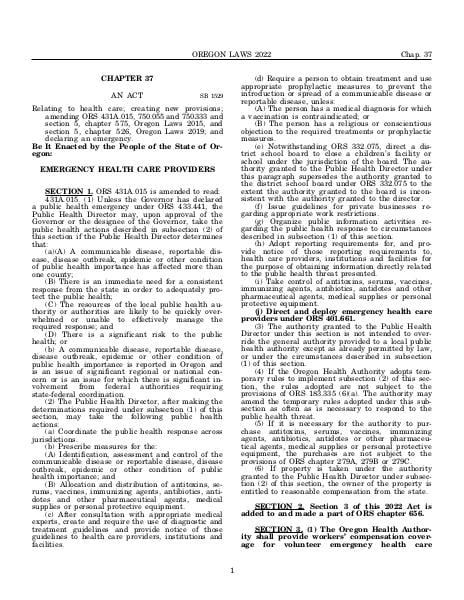

Relating to health care; creating new provisions; amending ORS 431A.015, 750.055 and 750.333 and section 5, chapter 575, Oregon Laws 2015, and section 5, chapter 526, Oregon Laws 2019; and declaring an emergency.

(1)

The following provisions apply to health care service contractors to the extent not inconsistent with the express provisions of ORS 750.005 (Definitions) to 750.095 (Requirements of contract between provider and subscriber):(a)

ORS 705.137 (Information that is confidential or not subject to disclosure), 705.138 (Confidential and privileged documents) and 705.139 (Agreements with other agencies regarding sharing and use of confidential information).(b)

ORS 731.004 (Short title) to 731.150 (Definitions of classes of insurance not mutually exclusive), 731.162 (“Health insurance.”), 731.216 (Administrative power of director) to 731.362 (Requirements of foreign or alien insurers generally), 731.382 (General eligibility for certificate of authority), 731.385 (Standards for determining whether continued operation of insurer is hazardous), 731.386 (Management of insurers), 731.390 (Government insurers not to be authorized), 731.398 (Amendment of certificate of authority) to 731.430 (Name of insurer), 731.428 (Written consent to engage or participate in business of insurance), 731.450 (Unrelated business prohibited), 731.454 (Domestic insurers not to transact business in jurisdiction where not authorized), 731.485 (Conditions under which insurer may limit insured’s choice of drug outlets and pharmacies), as provided in subsection (2) of this section, ORS 731.488 (Annual audit of insurer), 731.504 (Limit of risk), 731.508 (Approved reinsurance), 731.509 (Legislative intent), 731.510 (Criteria for allowing reduction from liability for reinsurance), 731.511 (Criteria to be met by assuming insurer in order to be accredited as reinsurer), 731.512 (Withdrawal of insurer), 731.574 (Annual financial statement) to 731.620 (Assignment of deposited securities), 731.640 (Eligible deposits) to 731.652 (Proofs for release of deposit to insurers), 731.730 (Insurer filings with National Association of Insurance Commissioners), 731.731 (Immunity for certain persons dealing with information collected from filings under ORS 731.730), 731.735 (Certain information confidential), 731.737 (Immunity from liability for certain persons filing reports or furnishing information about specified activities to specified persons), 731.750 (Confidentiality of report of material acquisitions or dispositions of assets, material nonrenewals, cancellations and revisions of ceded reinsurance agreements), 731.752 (Confidentiality of report used for determination of required amount of capital or surplus), 731.804 (Assessments), 731.808 (“Gross amount of premiums” defined) and 731.844 (No personal liability for paying invalid tax) to 731.992 (Criminal penalty).(c)

ORS 732.215 (Management contracts prohibited), 732.220 (Exclusive agency contracts), 732.230 (Order to cure impairment), 732.245 (Home office), 732.250 (Continuity of management in event of national emergency), 732.320 (Supporting documents for expenditures), 732.325 (Certain transactions and compensation between insurers and directors, trustees, officers, agents or employees prohibited) and 732.517 (Purpose of ORS 732.517 to 732.546) to 732.596 (Request by insurance holding company system for determination or acknowledgement of group-wide supervisor), not including ORS 732.582 (Determination of reasonableness and adequacy of capital and surplus).(d)

ORS 733.010 (Assets allowed) to 733.050 (Increase of inadequate reserves), 733.080 (Reserves for health insurance), 733.140 (Disallowance of “wash” transactions) to 733.170 (Accounts and records), 733.210 (Director’s determinations), 733.510 (Investments of insurers) to 733.680 (Acquisition and retention of personal property generally) and 733.695 (Investment of funds in obligations that are not investment quality) to 733.780 (Prohibited investments).(e)

ORS 734.014 (Definitions) to 734.440 (Judgment upon assessment).(f)

ORS 742.001 (Scope of ORS chapters 742, 743, 743A and 743B) to 742.009 (Regulation of sales material), 742.013 (Representations in applications), 742.016 (Policy constitutes entire contract), 742.061 (Recovery of attorney fees in action on policy or contractor’s bond), 742.065 (Insurance against risk of loss assumed under less than fully insured employee health benefit plan), 742.150 (Approval by director) to 742.162 (Transfer and novation of policy effected by director) and 742.518 (Definitions for ORS 742.518 to 742.542) to 742.542 (Effect of personal injury protection benefits paid).(g)

ORS 743.004 (Submission of information by carriers offering health benefit plans), 743.005 (Protection of health information report), 743.007 (Data reporting), 743.008 (Reporting requirements), 743.010 (Health insurance policy and health benefit plan forms), 743.018 (Filing of rates for life and health insurance), 743.020 (Rate filing to include statement of administrative expenses), 743.022 (Premium rates for individual health benefit plans), 743.023 (Electronic administration), 743.028 (Uniform health insurance claim forms), 743.029 (Uniform standards for health care financial and administrative transactions), 743.038 (Consent of individual required for life and health insurance), 743.040 (Personal insurance, insurable interest and beneficiaries), 743.044 (Life insurance for benefit of charity), 743.050 (Exemption of proceeds of health insurance), 743.100 (Short title) to 743.109 (Approval of certain policy forms containing specified provisions), 743.402 (Exceptions to individual health insurance policy requirements), 743.405 (General requirements for health insurance policies), 743.406 (Required provisions in group health insurance policies), 743.417 (Grace period for subsequent premium payments), 743.472 (Permissible reasons for cancellation or refusal to renew), 743.492 (Policy return and premium refund provision), 743.495 (Use of terms “noncancelable” or “guaranteed renewable”), 743.498 (Statement in policy of cancelability or renewability), 743.522 (Additional groups designated by director), 743.523 (Certain sales practices prohibited), 743.524 (Eligibility of association to be group health policyholder), 743.526 (Determination of whether trustees are policyholders), 743.535 (Health benefit coverage for guaranteed association), 743.550 (Student health insurance), 743.650 (Long Term Care Insurance Act) to 743.656 (Eligibility for benefits), 743.680 (Definitions for ORS 743.680 to 743.689) to 743.689 (Director’s authority upon violation of ORS 743.680 to 743.689), 743.788 (Prescription drug identification card) and 743.790 (Rules for prescription drug identification cards).(h)

ORS 743A.010 (Services provided by state hospital or state approved program), 743A.012 (Emergency services), 743A.014 (Payments for ambulance care and transportation), 743A.020 (Services provided by acupuncturist), 743A.034 (Services provided by expanded practice dental hygienist), 743A.036 (Services provided by licensed nurse practitioner or licensed physician assistant), 743A.040 (Services provided by optometrist), 743A.044 (Services provided by physician assistant), 743A.048 (Services provided by psychologist), 743A.051 (Services provided by pharmacist), 743A.052 (Services provided by professional counselor or marriage and family therapist), 743A.058 (Telemedicine services), 743A.060 (Definition for ORS 743A.062), 743A.062 (Prescription drugs), 743A.063 (Ninety-day supply of prescription drug refills), 743A.064 (Prescription drugs dispensed at rural health clinics), 743A.065 (Early refills of prescription eye drops for treatment of glaucoma), 743A.066 (Contraceptives), 743A.068 (Orally administered anticancer medication), 743A.070 (Nonprescription enteral formula for home use), 743A.080 (Pregnancy and childbirth expenses), 743A.082 (Diabetes management for pregnant women), 743A.084 (Unmarried women and their children), 743A.088 (Use by mother of diethylstilbestrol), 743A.090 (Natural and adopted children), 743A.100 (Mammograms), 743A.104 (Pelvic examinations and Pap smear examinations), 743A.105 (HPV vaccine), 743A.108 (Physical examination of breast), 743A.110 (Mastectomy-related services), 743A.124 (Colorectal cancer screenings and laboratory tests), 743A.140 (Bilateral cochlear implants), 743A.141 (Hearing aids and hearing assistive technology systems), 743A.148 (Maxillofacial prosthetic services), 743A.150 (Treatment of craniofacial anomaly), 743A.160 (Alcoholism treatment), 743A.168 (Behavioral health treatment), 743A.170 (Tobacco use cessation programs), 743A.175 (Traumatic brain injury), 743A.185 (Telemedical health services for treatment of diabetes), 743A.188 (Inborn errors of metabolism), 743A.190 (Children with pervasive developmental disorder), 743A.192 (Clinical trials), 743A.250 (Emergency eye care services), 743A.252 (Child abuse assessments) and 743A.260 (Inmates) and section 2, chapter 771, Oregon Laws 2013.(i)

ORS 743.025 (Rate filing to include prescription drug cost information), 743B.001 (Definitions), 743B.003 (Purposes) to 743B.127 (Rules for ORS 743.022, 743B.125 and 743B.126), 743B.128 (Exceptions to requirement to actively market all plans), 743B.130 (Requirement to offer bronze and silver plans), 743B.195 (Enforcement of Newborns’ and Mothers’ Health Protection Act of 1996), 743B.197 (Health Care Consumer Protection Advisory Committee), 743B.200 (Requirements for insurers offering managed health insurance), 743B.202 (Requirements for insurers offering managed health or preferred provider organization insurance), 743B.204 (Required managed health insurance contract provision), 743B.220 (Requirements for insurers that require designation of participating primary care physician), 743B.222 (Designation of women’s health care provider as primary care provider), 743B.225 (Continuity of care), 743B.227 (Referrals to specialists), 743B.250 (Required notices to applicants and enrollees), 743B.252 (External review), 743B.253 (Director to contract with independent review organizations to provide external review), 743B.254 (Required statements regarding external reviews), 743B.255 (Enrollee application for external review), 743B.256 (Duties of independent review organizations), 743B.257 (Civil penalty for failure to comply by insurer that agreed to be bound by decision), 743B.258 (Private right of action), 743B.280 (Definitions for ORS 743B.280 to 743B.285) to 743B.285 (Rules), 743B.287 (Balance billing prohibited for health care facility services), 743B.300 (Disclosure of differences in replacement health insurance policies), 743B.310 (Rescinding coverage), 743B.320 (Minimum grace period), 743B.323 (Separate notice to policyholder required before cancellation of individual or group health insurance policy for nonpayment of premium), 743B.330 (Notice to policyholder required for cancellation or nonrenewal of health benefit plan), 743B.340 (When group health insurance policies to continue in effect upon payment of premium by insured individual), 743B.341 (Continuation of benefits after termination of group health insurance policy), 743B.342 (Continuation of benefits after injury or illness covered by workers’ compensation), 743B.343 (Availability of continued coverage under group policy for surviving, divorced or separated spouse 55 or older) to 743B.347 (Continuation of coverage under group policy upon termination of membership in group health insurance policy), 743B.400 (Decisions regarding health care facility length of stay, level of care and follow-up care), 743B.403 (Insurer prohibited practices), 743B.407 (Naturopathic physicians), 743B.420 (Prior authorization requirements), 743B.423 (Utilization review requirements for insurers offering health benefit plan), 743B.450 (Prompt payment of claims), 743B.451 (Refund of paid claims), 743B.452 (Interest on unpaid claims), 743B.453 (Underpayment of claims), 743B.470 (Medicaid not considered in coverage eligibility determination), 743B.475 (Guidelines for coordination of benefits), 743B.505 (Provider networks), 743B.550 (Disclosure of information), 743B.555 (Confidential communications), 743B.601 (Synchronization of prescription drug refills), 743B.602 (Step therapy) and 743B.800 (Risk adjustment procedures).(j)

The following provisions of ORS chapter 744:(A)

ORS 744.052 (Definitions for ORS 744.052 to 744.089) to 744.089 (Report of administrative action taken against insurance producer), 744.091 (Additional conditions under which person licensed as insurer or insurance producer may charge commission or service fee) and 744.093 (Solicitation or sale of insurance policy by retail insurance producer or wholesale insurance producer), relating to the regulation of insurance producers;(B)

ORS 744.602 (Definitions) to 744.665 (Continuing education), relating to the regulation of insurance consultants; and(C)

ORS 744.700 (Definitions for ORS 744.700 to 744.740) to 744.740 (Responsibility of insurer using third party administrator), relating to the regulation of third party administrators.(k)

ORS 746.005 (Trade practices exempted from prohibitions) to 746.140 (Sale of life insurance with securities), 746.160 (Practices injurious to free competition), 746.220 (Debtor’s option in furnishing credit life or credit health insurance) to 746.370 (Records of insureds), 746.600 (Definitions for ORS 746.600 to 746.690), 746.605 (Purpose), 746.607 (Use and disclosure of personal information), 746.608 (Rules), 746.610 (Application of ORS 746.600 to 746.690), 746.615 (Pretext interviews prohibited), 746.625 (Marketing and research surveys), 746.635 (Investigative consumer reports), 746.650 (Reasons for adverse underwriting decisions), 746.655 (Information concerning previous adverse underwriting decisions), 746.660 (Basing adverse underwriting decision on previous adverse decision), 746.668 (Relationship of ORS 746.620, 746.630 and 746.665 to federal Fair Credit Reporting Act), 746.670 (Investigatory powers), 746.675 (Service of process on out-of-state insurance-support organizations), 746.680 (Remedies) and 746.690 (Obtaining information under false pretenses prohibited).(2)

The following provisions of the Insurance Code apply to health care service contractors except in the case of group practice health maintenance organizations that are federally qualified pursuant to Title XIII of the Public Health Service Act:(a)

ORS 731.485 (Conditions under which insurer may limit insured’s choice of drug outlets and pharmacies), if the group practice health maintenance organization wholly owns and operates an in-house drug outlet.(b)

ORS 743A.024 (Services provided by clinical social worker), unless the patient is referred by a physician, physician assistant or nurse practitioner associated with a group practice health maintenance organization.(3)

For the purposes of this section, health care service contractors are insurers.(4)

Any for-profit health care service contractor organized under the laws of any other state that is not governed by the insurance laws of the other state is subject to all requirements of ORS chapter 732.(5)

Intentionally left blank —Ed.(a)

A health care service contractor is a domestic insurance company for the purpose of determining whether the health care service contractor is a debtor, as defined in 11 U.S.C. 109.(b)

A health care service contractor’s classification as a domestic insurance company under paragraph (a) of this subsection does not subject the health care service contractor to ORS 734.510 (Definitions for ORS 734.510 to 734.710) to 734.710 (Administration of delinquency proceeding claims and expenses).(6)

The Director of the Department of Consumer and Business Services may, after notice and hearing, adopt reasonable rules not inconsistent with this section and ORS 750.003 (Purpose), 750.005 (Definitions), 750.025 (Restricting distribution of income) and 750.045 (Required capitalization) that are necessary for the proper administration of these provisions. [1967 c.359 §659; 1969 c.336 §18; 1971 c.231 §41; 1973 c.143 §5; 1973 c.515 §6; 1973 c.613 §4a; 1975 c.135 §3; 1975 c.338 §4a; 1975 c.689 §4; 1975 c.784 §13c; 1977 c.402 §6; 1979 c.268 §7; 1979 c.708 §11; 1979 c.785 §22a; 1979 c.797 §3a; 1981 c.254 §3; 1981 c.319 §3; 1981 c.422 §6; 1981 c.649 §22; 1981 c.752 §14; 1983 c.601 §9; 1985 c.747 §68; 1985 c.827 §3; 1987 c.411 §3; 1987 c.720 §3; 1987 c.739 §5; 1987 c.774 §62; 1987 c.838 §16; 1989 c.255 §13; 1989 c.425 §15; 1989 c.474 §4; 1989 c.701 §76; 1989 c.784 §14; 1989 c.832 §3; 1989 c.1022 §11; 1991 c.182 §18; 1991 c.401 §33; 1991 c.673 §8; 1991 c.812 §24; 1991 c.875 §3; 1991 c.916 §19; 1993 c.391 §3; 1993 c.447 §118; 1993 c.649 §14; 1995 c.30 §13; 1995 c.506 §3; 1995 c.623 §3; 1995 c.638 §9; 1995 c.669 §3; 1995 c.672 §8; 1997 c.343 §22; 1997 c.496 §4; 1997 c.573 §4; 1997 c.759 §5; 1999 c.428 §§4,5; 1999 c.633 §§7,8; 1999 c.749 §§3,4; 1999 c.987 §§22,23; 2001 c.191 §60; 2001 c.266 §16; 2001 c.377 §20; 2001 c.742 §4; 2001 c.747 §6; 2003 c.87 §19; 2003 c.91 §5; 2003 c.137 §7; 2003 c.263 §3; 2003 c.363 §14; 2003 c.364 §169; 2003 c.748 §3; 2003 c.802 §172; 2005 c.22 §§500,501,502; 2005 c.255 §§4,5,6; 2005 c.418 §5; 2007 c.128 §§2,3; 2007 c.182 §§8,9; 2007 c.313 §§5,6; 2007 c.504 §§3,4; 2007 c.566 §§3,4; 2007 c.872 §§3,4; 2008 c.22 §§5,6; 2009 c.274 §§3,4; 2009 c.383 §3; 2009 c.384 §§3,4; 2009 c.423 §§3,4; 2009 c.503 §§3,4; 2009 c.553 §§3,4; 2009 c.630 §§3,4; 2009 c.807 §§5,6; 2011 c.130 §7; 2011 c.312 §3; 2011 c.500 §43; 2011 c.660 §26; 2011 c.716 §13; 2012 c.21 §3; 2013 c.682 §3; 2013 c.698 §33; 2013 c.771 §8; 2014 c.25 §§5,6; 2014 c.45 §§80,81; 2015 c.59 §§7,8; 2015 c.100 §§5,6; 2015 c.224 §§5,6; 2015 c.362 §§9,10; 2015 c.470 §§8,9; 2015 c.515 §§28,29; 2017 c.206 §§8,9; 2017 c.417 §§4,5; 2017 c.479 §§20,21; 2018 c.7 §9; 2019 c.13 §68; 2019 c.151 §37; 2019 c.441 §4; 2021 c.97 §84](a)

ORS 705.137 (Information that is confidential or not subject to disclosure), 705.138 (Confidential and privileged documents) and 705.139 (Agreements with other agencies regarding sharing and use of confidential information).(b)

ORS 731.004 (Short title) to 731.150 (Definitions of classes of insurance not mutually exclusive), 731.162 (“Health insurance.”), 731.216 (Administrative power of director) to 731.362 (Requirements of foreign or alien insurers generally), 731.382 (General eligibility for certificate of authority), 731.385 (Standards for determining whether continued operation of insurer is hazardous), 731.386 (Management of insurers), 731.390 (Government insurers not to be authorized), 731.398 (Amendment of certificate of authority) to 731.430 (Name of insurer), 731.428 (Written consent to engage or participate in business of insurance), 731.450 (Unrelated business prohibited), 731.454 (Domestic insurers not to transact business in jurisdiction where not authorized), 731.485 (Conditions under which insurer may limit insured’s choice of drug outlets and pharmacies), as provided in subsection (2) of this section, ORS 731.488 (Annual audit of insurer), 731.504 (Limit of risk), 731.508 (Approved reinsurance), 731.509 (Legislative intent), 731.510 (Criteria for allowing reduction from liability for reinsurance), 731.511 (Criteria to be met by assuming insurer in order to be accredited as reinsurer), 731.512 (Withdrawal of insurer), 731.574 (Annual financial statement) to 731.620 (Assignment of deposited securities), 731.640 (Eligible deposits) to 731.652 (Proofs for release of deposit to insurers), 731.730 (Insurer filings with National Association of Insurance Commissioners), 731.731 (Immunity for certain persons dealing with information collected from filings under ORS 731.730), 731.735 (Certain information confidential), 731.737 (Immunity from liability for certain persons filing reports or furnishing information about specified activities to specified persons), 731.750 (Confidentiality of report of material acquisitions or dispositions of assets, material nonrenewals, cancellations and revisions of ceded reinsurance agreements), 731.752 (Confidentiality of report used for determination of required amount of capital or surplus), 731.804 (Assessments), 731.808 (“Gross amount of premiums” defined) and 731.844 (No personal liability for paying invalid tax) to 731.992 (Criminal penalty).(c)

ORS 732.215 (Management contracts prohibited), 732.220 (Exclusive agency contracts), 732.230 (Order to cure impairment), 732.245 (Home office), 732.250 (Continuity of management in event of national emergency), 732.320 (Supporting documents for expenditures), 732.325 (Certain transactions and compensation between insurers and directors, trustees, officers, agents or employees prohibited) and 732.517 (Purpose of ORS 732.517 to 732.546) to 732.596 (Request by insurance holding company system for determination or acknowledgement of group-wide supervisor), not including ORS 732.582 (Determination of reasonableness and adequacy of capital and surplus).(d)

ORS 733.010 (Assets allowed) to 733.050 (Increase of inadequate reserves), 733.080 (Reserves for health insurance), 733.140 (Disallowance of “wash” transactions) to 733.170 (Accounts and records), 733.210 (Director’s determinations), 733.510 (Investments of insurers) to 733.680 (Acquisition and retention of personal property generally) and 733.695 (Investment of funds in obligations that are not investment quality) to 733.780 (Prohibited investments).(e)

ORS 734.014 (Definitions) to 734.440 (Judgment upon assessment).(f)

ORS 742.001 (Scope of ORS chapters 742, 743, 743A and 743B) to 742.009 (Regulation of sales material), 742.013 (Representations in applications), 742.016 (Policy constitutes entire contract), 742.061 (Recovery of attorney fees in action on policy or contractor’s bond), 742.065 (Insurance against risk of loss assumed under less than fully insured employee health benefit plan), 742.150 (Approval by director) to 742.162 (Transfer and novation of policy effected by director) and 742.518 (Definitions for ORS 742.518 to 742.542) to 742.542 (Effect of personal injury protection benefits paid).(g)

ORS 743.004 (Submission of information by carriers offering health benefit plans), 743.005 (Protection of health information report), 743.007 (Data reporting), 743.008 (Reporting requirements), 743.010 (Health insurance policy and health benefit plan forms), 743.018 (Filing of rates for life and health insurance), 743.020 (Rate filing to include statement of administrative expenses), 743.022 (Premium rates for individual health benefit plans), 743.023 (Electronic administration), 743.028 (Uniform health insurance claim forms), 743.029 (Uniform standards for health care financial and administrative transactions), 743.038 (Consent of individual required for life and health insurance), 743.040 (Personal insurance, insurable interest and beneficiaries), 743.044 (Life insurance for benefit of charity), 743.050 (Exemption of proceeds of health insurance), 743.100 (Short title) to 743.109 (Approval of certain policy forms containing specified provisions), 743.402 (Exceptions to individual health insurance policy requirements), 743.405 (General requirements for health insurance policies), 743.406 (Required provisions in group health insurance policies), 743.417 (Grace period for subsequent premium payments), 743.472 (Permissible reasons for cancellation or refusal to renew), 743.492 (Policy return and premium refund provision), 743.495 (Use of terms “noncancelable” or “guaranteed renewable”), 743.498 (Statement in policy of cancelability or renewability), 743.522 (Additional groups designated by director), 743.523 (Certain sales practices prohibited), 743.524 (Eligibility of association to be group health policyholder), 743.526 (Determination of whether trustees are policyholders), 743.535 (Health benefit coverage for guaranteed association), 743.550 (Student health insurance), 743.650 (Long Term Care Insurance Act) to 743.656 (Eligibility for benefits), 743.680 (Definitions for ORS 743.680 to 743.689) to 743.689 (Director’s authority upon violation of ORS 743.680 to 743.689), 743.788 (Prescription drug identification card) and 743.790 (Rules for prescription drug identification cards).(h)

ORS 743A.010 (Services provided by state hospital or state approved program), 743A.012 (Emergency services), 743A.014 (Payments for ambulance care and transportation), 743A.020 (Services provided by acupuncturist), 743A.034 (Services provided by expanded practice dental hygienist), 743A.036 (Services provided by licensed nurse practitioner or licensed physician assistant), 743A.040 (Services provided by optometrist), 743A.044 (Services provided by physician assistant), 743A.048 (Services provided by psychologist), 743A.051 (Services provided by pharmacist), 743A.052 (Services provided by professional counselor or marriage and family therapist), 743A.058 (Telemedicine services), 743A.060 (Definition for ORS 743A.062), 743A.062 (Prescription drugs), 743A.063 (Ninety-day supply of prescription drug refills), 743A.064 (Prescription drugs dispensed at rural health clinics), 743A.065 (Early refills of prescription eye drops for treatment of glaucoma), 743A.066 (Contraceptives), 743A.068 (Orally administered anticancer medication), 743A.070 (Nonprescription enteral formula for home use), 743A.080 (Pregnancy and childbirth expenses), 743A.082 (Diabetes management for pregnant women), 743A.084 (Unmarried women and their children), 743A.088 (Use by mother of diethylstilbestrol), 743A.090 (Natural and adopted children), 743A.100 (Mammograms), 743A.104 (Pelvic examinations and Pap smear examinations), 743A.105 (HPV vaccine), 743A.108 (Physical examination of breast), 743A.110 (Mastectomy-related services), 743A.124 (Colorectal cancer screenings and laboratory tests), 743A.140 (Bilateral cochlear implants), 743A.141 (Hearing aids and hearing assistive technology systems), 743A.148 (Maxillofacial prosthetic services), 743A.150 (Treatment of craniofacial anomaly), 743A.160 (Alcoholism treatment), 743A.168 (Behavioral health treatment), 743A.170 (Tobacco use cessation programs), 743A.175 (Traumatic brain injury), 743A.185 (Telemedical health services for treatment of diabetes), 743A.188 (Inborn errors of metabolism), 743A.190 (Children with pervasive developmental disorder), 743A.192 (Clinical trials), 743A.250 (Emergency eye care services), 743A.252 (Child abuse assessments) and 743A.260 (Inmates).(i)

ORS 743.025 (Rate filing to include prescription drug cost information), 743B.001 (Definitions), 743B.003 (Purposes) to 743B.127 (Rules for ORS 743.022, 743B.125 and 743B.126), 743B.128 (Exceptions to requirement to actively market all plans), 743B.130 (Requirement to offer bronze and silver plans), 743B.195 (Enforcement of Newborns’ and Mothers’ Health Protection Act of 1996), 743B.197 (Health Care Consumer Protection Advisory Committee), 743B.200 (Requirements for insurers offering managed health insurance), 743B.202 (Requirements for insurers offering managed health or preferred provider organization insurance), 743B.204 (Required managed health insurance contract provision), 743B.220 (Requirements for insurers that require designation of participating primary care physician), 743B.222 (Designation of women’s health care provider as primary care provider), 743B.225 (Continuity of care), 743B.227 (Referrals to specialists), 743B.250 (Required notices to applicants and enrollees), 743B.252 (External review), 743B.253 (Director to contract with independent review organizations to provide external review), 743B.254 (Required statements regarding external reviews), 743B.255 (Enrollee application for external review), 743B.256 (Duties of independent review organizations), 743B.257 (Civil penalty for failure to comply by insurer that agreed to be bound by decision), 743B.258 (Private right of action), 743B.280 (Definitions for ORS 743B.280 to 743B.285) to 743B.285 (Rules), 743B.287 (Balance billing prohibited for health care facility services), 743B.300 (Disclosure of differences in replacement health insurance policies), 743B.310 (Rescinding coverage), 743B.320 (Minimum grace period), 743B.323 (Separate notice to policyholder required before cancellation of individual or group health insurance policy for nonpayment of premium), 743B.330 (Notice to policyholder required for cancellation or nonrenewal of health benefit plan), 743B.340 (When group health insurance policies to continue in effect upon payment of premium by insured individual), 743B.341 (Continuation of benefits after termination of group health insurance policy), 743B.342 (Continuation of benefits after injury or illness covered by workers’ compensation), 743B.343 (Availability of continued coverage under group policy for surviving, divorced or separated spouse 55 or older) to 743B.347 (Continuation of coverage under group policy upon termination of membership in group health insurance policy), 743B.400 (Decisions regarding health care facility length of stay, level of care and follow-up care), 743B.403 (Insurer prohibited practices), 743B.407 (Naturopathic physicians), 743B.420 (Prior authorization requirements), 743B.423 (Utilization review requirements for insurers offering health benefit plan), 743B.450 (Prompt payment of claims), 743B.451 (Refund of paid claims), 743B.452 (Interest on unpaid claims), 743B.453 (Underpayment of claims), 743B.470 (Medicaid not considered in coverage eligibility determination), 743B.475 (Guidelines for coordination of benefits), 743B.505 (Provider networks), 743B.550 (Disclosure of information), 743B.555 (Confidential communications), 743B.601 (Synchronization of prescription drug refills), 743B.602 (Step therapy) and 743B.800 (Risk adjustment procedures).(j)

The following provisions of ORS chapter 744:(A)

ORS 744.052 (Definitions for ORS 744.052 to 744.089) to 744.089 (Report of administrative action taken against insurance producer), 744.091 (Additional conditions under which person licensed as insurer or insurance producer may charge commission or service fee) and 744.093 (Solicitation or sale of insurance policy by retail insurance producer or wholesale insurance producer), relating to the regulation of insurance producers;(B)

ORS 744.602 (Definitions) to 744.665 (Continuing education), relating to the regulation of insurance consultants; and(C)

ORS 744.700 (Definitions for ORS 744.700 to 744.740) to 744.740 (Responsibility of insurer using third party administrator), relating to the regulation of third party administrators.(k)

ORS 746.005 (Trade practices exempted from prohibitions) to 746.140 (Sale of life insurance with securities), 746.160 (Practices injurious to free competition), 746.220 (Debtor’s option in furnishing credit life or credit health insurance) to 746.370 (Records of insureds), 746.600 (Definitions for ORS 746.600 to 746.690), 746.605 (Purpose), 746.607 (Use and disclosure of personal information), 746.608 (Rules), 746.610 (Application of ORS 746.600 to 746.690), 746.615 (Pretext interviews prohibited), 746.625 (Marketing and research surveys), 746.635 (Investigative consumer reports), 746.650 (Reasons for adverse underwriting decisions), 746.655 (Information concerning previous adverse underwriting decisions), 746.660 (Basing adverse underwriting decision on previous adverse decision), 746.668 (Relationship of ORS 746.620, 746.630 and 746.665 to federal Fair Credit Reporting Act), 746.670 (Investigatory powers), 746.675 (Service of process on out-of-state insurance-support organizations), 746.680 (Remedies) and 746.690 (Obtaining information under false pretenses prohibited).(2)

The following provisions of the Insurance Code apply to health care service contractors except in the case of group practice health maintenance organizations that are federally qualified pursuant to Title XIII of the Public Health Service Act:(a)

ORS 731.485 (Conditions under which insurer may limit insured’s choice of drug outlets and pharmacies), if the group practice health maintenance organization wholly owns and operates an in-house drug outlet.(b)

ORS 743A.024 (Services provided by clinical social worker), unless the patient is referred by a physician, physician assistant or nurse practitioner associated with a group practice health maintenance organization.(3)

For the purposes of this section, health care service contractors are insurers.(4)

Any for-profit health care service contractor organized under the laws of any other state that is not governed by the insurance laws of the other state is subject to all requirements of ORS chapter 732.(5)

Intentionally left blank —Ed.(a)

A health care service contractor is a domestic insurance company for the purpose of determining whether the health care service contractor is a debtor, as defined in 11 U.S.C. 109.(b)

A health care service contractor’s classification as a domestic insurance company under paragraph (a) of this subsection does not subject the health care service contractor to ORS 734.510 (Definitions for ORS 734.510 to 734.710) to 734.710 (Administration of delinquency proceeding claims and expenses).(6)

The Director of the Department of Consumer and Business Services may, after notice and hearing, adopt reasonable rules not inconsistent with this section and ORS 750.003 (Purpose), 750.005 (Definitions), 750.025 (Restricting distribution of income) and 750.045 (Required capitalization) that are necessary for the proper administration of these provisions.

Source:

Section 750.055 — Other provisions applicable to health care service contractors; rules, https://www.oregonlegislature.gov/bills_laws/ors/ors750.html.