Terms have same meaning as in federal laws

- federal law references

Amended by SB 1525

Effective since June 3, 2022

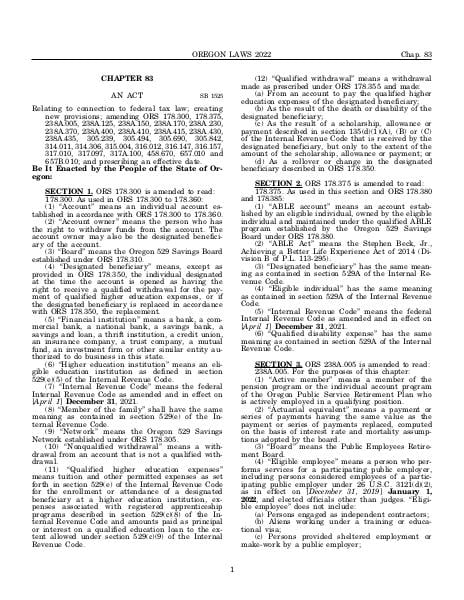

Relating to connection to federal tax law; creating new provisions; amending ORS 178.300, 178.375, 238A.005, 238A.125, 238A.150, 238A.170, 238A.230, 238A.370, 238A.400, 238A.410, 238A.415, 238A.430, 238A.435, 305.239, 305.494, 305.690, 305.842, 314.011, 314.306, 315.004, 316.012, 316.147, 316.157, 317.010, 317.097, 317A.100, 458.670, 657.010 and 657B.010; and prescribing an effective date.

Source:

Section 316.012 — Terms have same meaning as in federal laws; federal law references, https://www.oregonlegislature.gov/bills_laws/ors/ors316.html.

Notes of Decisions

Plaintiff’s expenses were incurred “while away from home in the pursuit of a trade or business” and therefore deductible under Internal Revenue Code of 1954, §162 (a) (2). Hilyard v. Dept. of Rev., 5 OTR 619 (1975)

Where a nonbusiness loan was secured by valuable property, the security interest disqualified it for deduction under the Internal Revenue Code of 1954, §166 (d) (1) (B). Johnson v. Dept. of Rev., 6 OTR 21 (1975)

In computing gain on the sale of stock for income tax purposes, the cost basis on acquisition is used, not the value when the taxpayer became a resident of Oregon. Ray v. Dept. of Rev., 6 OTR 184 (1975)

Income from distribution of assets held by Klamath Indian Management Trust was taxable by state. Bettles v. Dept. of Rev., 7 OTR 153 (1977)

Attorney General Opinions

Political contributions as credit against Oregon tax return, (1974) Vol 37, p 159