Qualifications of persons representing taxpayer

- procedure for designating representative

- rules

Amended by SB 1525

Effective since June 3, 2022

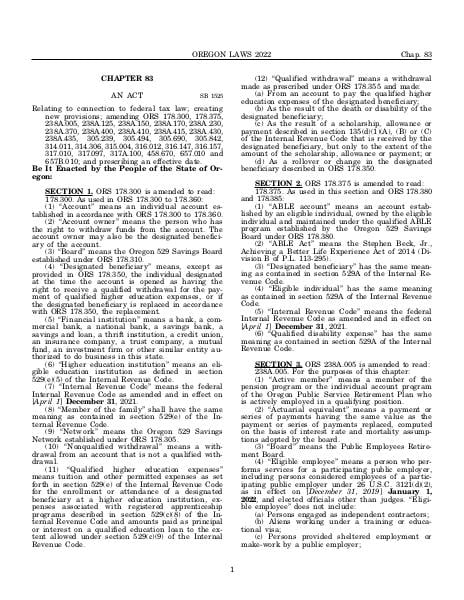

Relating to connection to federal tax law; creating new provisions; amending ORS 178.300, 178.375, 238A.005, 238A.125, 238A.150, 238A.170, 238A.230, 238A.370, 238A.400, 238A.410, 238A.415, 238A.430, 238A.435, 305.239, 305.494, 305.690, 305.842, 314.011, 314.306, 315.004, 316.012, 316.147, 316.157, 317.010, 317.097, 317A.100, 458.670, 657.010 and 657B.010; and prescribing an effective date.

Source:

Section 305.239 — Qualifications of persons representing taxpayer; procedure for designating representative; rules, https://www.oregonlegislature.gov/bills_laws/ors/ors305.html.

Notes of Decisions

Under this section, Department of Revenue must refuse recognition of claim of representation until taxpayer notifies department that representative has been authorized to act on his behalf. Barron v. Dept. of Rev., 11 OTR 305 (1989)