Time for payments

- delinquency

- foreclosure

Amended by HB 4021

Effective since June 3, 2022

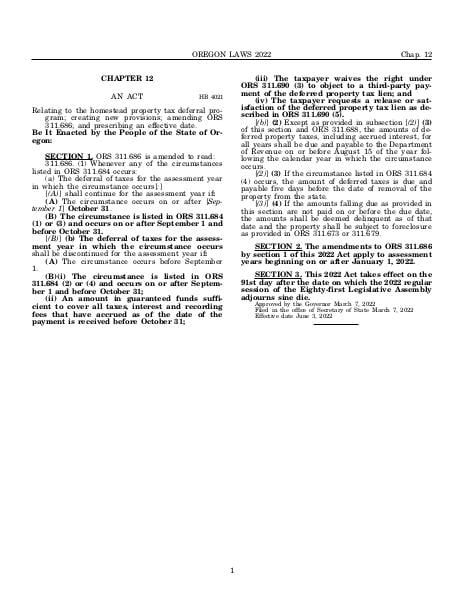

Relating to the homestead property tax deferral program; creating new provisions; amending ORS 311.686; and prescribing an effective date.

Source:

Section 311.686 — Time for payments; delinquency; foreclosure, https://www.oregonlegislature.gov/bills_laws/ors/ors311.html.